The Ather Energy Story

Plus: The competitive and regulatory landscape of the EV two-wheeler space in India

India is the largest two-wheeler market in the world. More than 18 million scooters have been sold in the country in 2024 so far, according to the data published by VAHAN, which is a 7% increase over last year. 80% of all passenger vehicles sold in India this year have been two-wheelers.

As the middle class expands, the demand for 2Ws is expected to rise further in the coming years. There is another trend you could not have missed over the last decade which has taken off globally: Electric Vehicles!

Just about 15 years ago, EVs were a niche class of vehicles with no standing against fuel-powered vehicles. Most of the legacy auto manufacturers did not take the electric revolution very seriously. To be fair, the EVs back then were both slower and more expensive as compared to petrol- or diesel-powered vehicles. It was hard to anticipate the growth this “niche” has witnessed in the last decade from both the demand side and supply side.

Some key factors facilitating EV penetration in India (can also broadly apply to the global scenario):

Price parity: An obvious hurdle to mass adoption for any new technology is the affordability factor. Fueled by investor capital and regulatory support by way of subsidies, EV companies have mitigated this hurdle by being able to price their products competitively against internal combustion engine (ICE) variants.

Expanding distribution and service infrastructure: The EV ecosystem appears to have breached the inflection point of adoption; as more people opt for electric vehicles, the virtuous cycle of growing distribution and service networks, in turn leading to making EVs more readily available, will likely continue.

Lower TCO of EVs: Even in a situation where an EV has a higher upfront cost vs an otherwise comparable ICE variant, the lower costs of operating and maintaining an EV will generally lead to an equivalent, if not lower, Total Cost of Ownership (TCO).

India has also witnessed a paradigm shift in EV adoption. This post focuses on the Indian electric two-wheeler (E2W) market, and more specifically, a pioneer of the industry: Ather Energy Limited.

Ather Energy is a billion-dollar electric-scooter company founded in 2013 by IIT Madras alumni Swapnil Jain and Tarun Mehta. The company sold over one lakh (100,000) electric scooters in the latest fiscal year (2024) and is currently preparing for a Rs 3,100 crore IPO, expected to launch in the coming few weeks.

Swapnil and Atul had conceptualized Ather Energy as a clean-energy venture five years before the company officially launched.

The founders completed their B. Tech in Engineering Design from IIT Madras in 2012. One of them had filed a patent for a battery pack design and they decided to survey the users of electric scooters to figure out the problems they could potentially solve for them.

They quickly discovered a gaping hole in the market - although the concept of electric scooters was fresh, and there were some E2Ws in the market, they didn’t fit the bill for an enthusiast.

Almost any new technology is first embraced by the early adopters before heading towards mass adoption.

Early adopters of electric scooters loved the idea of an E2W, but the existing scooters were nowhere close to being a substitute for the traditional petrol scooter. They were somewhere between a bicycle and a scooter with top speeds much lower than their ICE counterparts. Another limitation at the time was the lacking charging and service infrastructure for E2Ws at the time.

The duo had their work cut out for them.

Within six months of graduation, in 2013, both Swapnil and Tarun decided to quit their jobs and pursue Ather Energy officially. They returned to the Department of Engineering Design at IIT Madras to work on a prototype and eventually got incubated at the IIT Madras Incubation Cell.

Initial Fundraise

In early 2014, Ather received Rs 45 lakhs as funding from the Technology Development Board under the Department of Science and Technology, IIT-M, and Srini V Srinivasan, an IIT-M alumnus and founder of Aerospike.

The goal: To build an electric scooter as good as, if not better than, an ICE scooter.

The founders quickly recognized the scale of cost and complexity involved, especially at a time when there is virtually no competition, and you have to solve every problem by yourself without any precedents to rely on.

Ather needed to iterate consistently to fail fast, and fail forward, and it needed a lot of capital to do so!

It was difficult to find investors initially as building electric scooters for the Indian market was a risky proposition, with looming uncertainty from both the demand side and supply side.

Manufacturing was costly as the ecosystem wasn’t well-established (no economies of scale).

It was very hard to determine whether the product would be accepted by the market.

Ather needed patient capital to work towards its vision.

Sachin Bansal and Binny Bansal, co-founders of Flipkart, eventually invested $1 million as seed capital in late-2014. Another big push for the startup came in mid-2015 as they onboarded Tiger Global onto their cap table during their Series A round with $12 million to support the development, testing, production, and launch of their electric scooter.

A year later, in October 2016, India’s largest two-wheeler manufacturer - Hero MotoCorp - anticipated the tailwinds in the E2W space and wanted in on the action. Hero invested ₹205 crore (approximately $30.5 million) during Ather's Series B funding round for a ~30% stake in the company.

This investment was special for Ather because it signaled validation from a legacy player. Tarun said in an interview, “Investment from Hero is a big positive signal. [This implies] that they’re not just playing a valuation game but see potential in the business.”

Ather was clear from the start that they would not try to compete with incumbents like Bajaj Auto or TVS Motor on their supply chain efficiency or distribution prowess. Instead, they intended to carve a niche for themselves where the competition was non-existent - Smart electric scooters for aspirational early adopters: Two-wheelers which performed as well, if not better, than their petrol counterparts and commanded premium pricing.

Peter Thiel explains this framework in his book Zero to One - “Competition is for losers.” He argues that businesses should strive to create monopolies rather than enter highly competitive markets where profits are eroded. Ather wanted to implement a similar strategy.

Although, we will soon see that simply because you want to avoid competition, does not mean that the competition will avoid you.

Meanwhile, Ather was in grind mode; they were trying to build the best electric scooter they possibly could. Here’s a crucial insight from Tarun on ‘systems thinking and managing trade-offs’ from an interview with India Brand Equity Foundation (2016):

“We’re not trying to build the best battery pack, or the best charger, or the best dashboard. Those are very disparate and conflicting objectives. The best battery pack might need a life of a million kilometers, or it might need to work from -50 degrees to +100 degrees. You would have to worry about that if you were trying to build the best battery pack. But when you’re building the best scooter, the objectives change a little bit. You don’t need to build a battery the size of a mobile phone, even if it’s slightly bigger, it’s okay.

Instead of focusing on individual excellence, we’re trying to achieve an excellent system.”

Ather finally got their first breakthrough with the Ather 450, and its lower-end sibling, the Ather 340 in September 2018. The Ather 340 was soon discontinued due to low demand while the Ather 450 was received warmly by the market. It was eventually also made available in Chennai in October 2019. A couple of months later in January 2020, Ather introduced the next generation of the 450 series: Ather 450X.

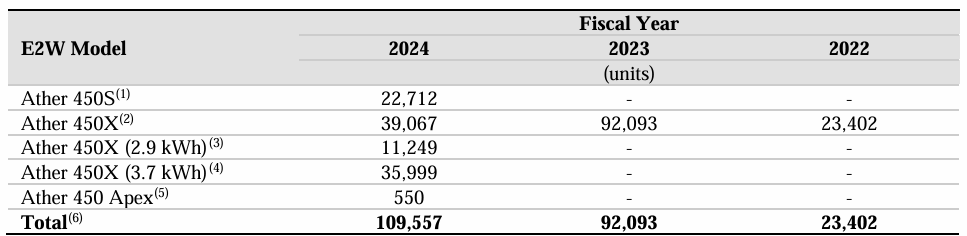

The Ather 450 line-up *clicked* with the customers, and their sales shot up. Ather ended up selling 3,000 and 8,000 scooters in FY2020 and FY2021 respectively. Look at what happened in the following three years.

The natural progression for Ather is to go mass market. As the company readies itself for a much-anticipated IPO, Ather launched the Rizta series in April 2024, marketing the line-up as a family scooter. During the festive season of Diwali in October 2024, Ather set a personal record of 20,000 scooter sales in a month. The Ather Rizta accounted for ~60-70% of the total volume for the month, marking the widespread acceptance of the new lineup by the market.

Time to Scale Up!

Ather plans to raise INR 3,100 crore via their upcoming IPO as they plan to level up their manufacturing capacity. Ather recognizes the need to move fast as competitors fight tooth and nail for a bigger share of the fast-growing E2W market.

The company currently has a manufacturing plant in Hosur, Tamil Nadu with a total installed capacity of 420,000 scooters.

Ather plans to use the proceeds from the IPO to set up a manufacturing plant in Chhatrapati Sambhaji Nagar, Maharashtra. This unit will increase their manufacturing capacity by one million units a year and is strategically located to enhance Ather’s penetration in Maharashtra and other important markets across the country.

The sales mix for the company is currently concentrated within Southern India at ~70%. Their footprint in Western India has shrunk over the last 3 years from 24% to 16% as at March 2024. Meanwhile, Northern India has also remained in single digits over the last 3 fiscal years, currently at 9%.

Meanwhile, data suggests that states like Maharashtra, Uttar Pradesh, and Rajasthan accounted for 1 out of every 3 electric scooters sold in 2024 (as of December first week). Maharashtra is at the top with 18% of the total E2W sales.

The plant in Maharashtra should enable Ather to expand into the majorly uncharted, but commercially significant, territories of Northern and Western India.

Another big chunk of the IPO proceeds will go towards research and development. Although most of Ather’s revenue currently comes from scooter sales, the advantage of a software-enabled platform is that it can be monetized aggressively.

One such example: The App Store! Apple made money by putting iPhones in people’s pockets, and they also make money from the commissions they charge on the apps sold through the App Store (plus all In-App Purchases!)

Technology, both software and hardware, is a big part of Ather’s strategy to build out the Ather suite of products and services. Services like Ather Grid and AtherStack are a significant part of the Ather ecosystem.

Ather Grid is Ather’s charging infrastructure across the country. The company tied up with Hero in Dec 2023 to enable interoperability between the charging infrastructure of the two companies. This enables Ather users to charge their scooters using Hero’s charging infrastructure and vice versa. Their combined charging network stands at 3100+ charging points across the country.

AtherStack is the company’s software suite. The platform provides features related to navigation, analytics, ride assistance, safety and productivity, as well as integration with the charging infrastructure. You can think of this as a built-in tablet for your scooter. The software updates are pushed over-the-air (OTA), exactly how updates are pushed to your Android or iPhone.

A majorly untapped area of growth for the Indian E2W space is international expansion.

Ather made its first impression outside of India as it launched in Nepal last year in November. Ahead of its IPO, the company also opened its first Experience Centre in Colombo, Sri Lanka, marking its second international market.

What About the Competition?

Ather has grown from 3,000 scooters sold in FY2020 to over 100,000 units in FY2024. This is an impressive growth trajectory! Although, when we zoom out to take a broader look at the electric 2-wheeler (E2W) space, we find out that other players are scaling up as well, and fast!

Ola Electric, with the resources to build a large-scale enterprise from the get-go, has been the undisputed market leader in the E2W space over the last couple of years. Ola’s first scooter, the Ola S1, was launched in 2021. Over the last 3 years, Ola has more than doubled its market share from 17% in 2022 to 36% in 2024.

Ola is not the only competition for Ather. Remember earlier, when Tarun admittedly did not want to compete with the legacy players on supply chain and distribution. Well, incumbents like TVS Motor and Bajaj are not shying away from utilizing their operational excellence, built and perfected over decades. The 2W giants have launched their E2W lineups over the last few years. TVS Motor’s iQube, and Bajaj’s Chetak.

At the time of writing this in mid-December 2024, both TVS and Bajaj have a market share of 19% and 17% respectively.

In a 2021 interview with PowerDrift, Tarun provided a meaningful insight into psyche of a 2W customer, “Contrary to what people might imagine, customers are not making the cheapest purchase, they’re making a safe purchase.”

The context of this statement was regarding Ather’s strong position as a premium e-scooter in the market, but this insight can also explain why TVS and Bajaj are growing quickly in the E2W space. These brands have built trust and goodwill with customers over decades, which would be tricky to quantify and beat in terms of cost and features.

Ather, meanwhile, has seen its market share hovering around 10-12% for the last 3 years. Maybe the Rizta line-up will help the company capture additional market share in the coming quarters? We’ll need to wait and watch.

Path to Profitability

Cash burn is a common phenomenon in the initial years of a startup. Companies in the pre-scaling stage are typically focused on developing their products, building capabilities, establishing their brand. Capital investments are also massive during this time. Eventually, the cash burn rate reduces as companies establish themselves in the market and start generating positive cash flow and profit margin. This implies a strategic pivot towards a profitable and sustainable business model.

Ather is no exception. The focus on profitability is now more than ever for the company as they prepare to go public.

During FY2024, Ather’s revenues dipped 1.5% after a 4x jump in FY2023. However, the EBITDA Margin has seen improvement from -62% to -36% over the last 2 fiscal years.

Ather’s management, in the DRHP, highlights the various levers they can pull to help the company chart a path to profitability; we discuss the primary ones below. It’s interesting to note that while points 1, 2, and 3 are applicable to traditional automobile companies also, point 4 is more relevant for Electric Vehicles with a larger number of software-based offerings.

Cost optimization: Ather has highlighted in its prospectus that they have reduced the input costs for the Ather 450X by 26% through reductions in the costs of the electronics, mechanical, and battery components. This can be further improved through investments in R&D and technological capabilities, and by negotiating favorable terms with suppliers. A related aspect of cost optimization is vertical integration, manufacturing components like cells, battery packs, and other components in-house to enhance quality and possibly reduced costs.

Operating leverage: Scale is crucial to ensure favorable unit economics in manufacturing. In a favorable economic environment, Ather should be able to increase production without incurring additional fixed cost (sweating their existing assets), driving the incremental gross margin straight to its bottom line.

Product differentiation: This is a significant factor to enhance profitability and is one which is very difficult to quantify. Ather’s strategy in this regard is two-fold, a) strengthening the Ather brand through marketing efforts, and b) establishing the Ather ecosystem with offerings such as Ather Grid, AtherStack, and their new smart helmet Ather Halo.

Revenue streams: These are pretty straightforward for traditional automotive business - vehicles sales, accessory sales, and aftermarket. With current-gen EVs being software driven, there are recurring revenue opportunities in the software side through selling customer experiences by monetizing certain features and functionality in a vehicle. For example, here is a video of Tesla’s fart horn and some other cool features, some of which you can activate by paying extra!

It’ll be interesting to see how the company’s strategy materializes in the near future.

How Supportive is the Policy Framework for EVs?

We now turn our attention to the regulatory landscape to analyze the significance of government support for EV manufacturing in India.

E2W sales have more than 10x’ed within the last 4 years from ~10,000 scooters a month in 2021 to more than 100,000 units sold last month. We discussed the structural changes the industry has undergone over the last decade. One significant aspect to watch out for is the support lent to the industry by the government.

The data suggests that the government, via measures such as subsidy schemes, has played a critical in the growth of the industry. The chart above shows the sales of E2W in India on a monthly basis. Do you also notice the sudden and significant dip in sales during June 2023 and April 2024. What happened in these months, exactly?

Well, the FAME II subsidy scheme has helped keep the prices of E2W down, making them competitive against petrol scooters. Effective 1st June 2023, the subsidy amount was reduced from 40% to 15%.

The second shock (but not a surprise) for the industry came in April 2024 as the FAME II scheme concluded on 31st March 2024. Sales went from touching an all-time monthly high of ~1,40,000 to 65,000 in the month after.

The government had to intervene and introduce temporary relief by way of the Electric Mobility Promotion Scheme (EMPS) 2024 to stimulate the market. The government further approved the PM E-Drive Scheme in September 2024 with an allocation of $1.3 billion to promote EV adoption across various segments. The consumers couldn’t be happier, October 2024 saw a big spike in volumes and reaching close to record high sales of ~1,40,000 units.

All of this to say that although the consumers are excited to go electric, the industry does rely on support to stay competitive with ICE scooters, at the moment. As the landscape evolves and the market is able to benefit from positive economics of scale, the need for subsidies would gradually fade away - although it may take a while.

Conclusion

The E2W market is an exciting and fast-evolving space, especially when you look at the size of the opportunity. Based on 2024 sales data (as on 6 December 2024), ICE scooters still dominate the industry with a 90% market share of two-wheelers, 94% if you add up the Petrol/Ethanol variants.

A silver lining for the electric scooter industry is that this number has come down from 99% in 2021. The market share of E2Ws have grown exponentially over the last 3 years, and given the positive sentiment from the most significant stakeholders - the investors, the lawmakers, and the customers - I anticipate a much bigger chunk of two-wheelers being eaten up by electric scooters, the key question is - which companie(s) will be the biggest beneficiaries of this opportunity?